Top 10 Ways to Prepare for Retirement

March 4, 2025

Discover the top 10 foolproof ways to prepare for retirement and secure your financial future

Understanding Retirement Readiness

Retirement readiness refers to the state of being financially prepared for retirement. It involves a combination of careful planning, saving, and investment strategies to ensure a comfortable and secure retirement. In this section, we will explore the importance of preparing for retirement and the key components of retirement readiness.

Importance of Preparing for Retirement

Preparing for retirement is crucial to secure your financial future and maintain a comfortable lifestyle during your golden years. Here are some reasons why retirement preparation is important:

- Financial Independence: Retirement allows individuals to transition from relying on earned income to living off their savings and investments. Adequate preparation ensures that you can maintain financial independence and cover your expenses without relying solely on government assistance or family support.

- Longevity: People are living longer, which means retirement can last for several decades. Planning ahead helps ensure that you have enough funds to sustain your lifestyle throughout your retirement years.

- Healthcare Costs: As we age, healthcare expenses tend to increase. Preparing for retirement allows you to account for potential medical costs and have adequate health insurance coverage, such as Medicare or private health insurance.

- Lifestyle Choices: Retirement offers the opportunity to pursue hobbies, travel, and enjoy leisure activities. Adequate preparation allows you to afford these lifestyle choices without worrying about financial constraints.

Key Components of Retirement Readiness

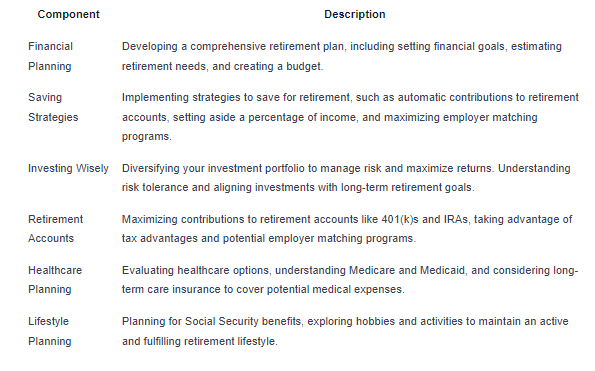

Retirement readiness involves several key components that contribute to a secure and comfortable retirement. Here are some important factors to consider:

By focusing on these key components, individuals can improve their retirement readiness and have a greater sense of financial security as they approach their retirement years. It's essential to start planning early, stay informed about retirement options, and regularly review and adjust your retirement strategy to adapt to changing circumstances.

Setting Financial Goals

When it comes to preparing for retirement, setting clear financial goals is an essential first step. This section focuses on two key aspects of setting financial goals: calculating retirement needs and implementing budgeting and saving strategies.

Calculating Retirement Needs

Before you can effectively plan for retirement, it's crucial to have a good understanding of how much money you will need. Calculating your retirement needs involves estimating your future expenses and determining the amount of savings required to sustain your desired lifestyle.

To calculate your retirement needs, consider the following factors:

- Current Expenses: Start by assessing your current monthly expenses. This will serve as a baseline for estimating your future needs. Consider expenses such as housing, utilities, transportation, healthcare, and leisure activities.

- Inflation: Factor in the impact of inflation on your expenses. Inflation erodes the purchasing power of money over time, so it's important to account for this when projecting your future needs. A common estimate for inflation is around 3% per year.

- Retirement Duration: Estimate the number of years you expect to be in retirement. This will depend on factors such as your desired retirement age and life expectancy. Remember to consider the potential for a longer retirement period as life expectancies continue to increase.

- Healthcare Costs: Healthcare expenses tend to increase in retirement. Consider the potential costs of medical insurance, prescription drugs, and long-term care.

Once you have these factors in mind, you can use retirement calculators or consult with a financial advisor to estimate your retirement needs. These tools will help you determine how much money you should aim to save for a comfortable retirement.

Budgeting and Saving Strategies

Once you have a target retirement savings goal in mind, it's time to develop a budget and implement saving strategies to help you reach that goal. Here are a few strategies to consider:

- Track Your Expenses: Start by analyzing your current spending habits. Keep a record of your expenses for a few months to identify areas where you can reduce unnecessary spending.

- Create a Realistic Budget: Based on your expense tracking, create a budget that aligns with your financial goals. Allocate funds for essentials, such as housing and healthcare, as well as discretionary spending.

- Automate Savings: Set up automatic transfers from your paycheck or checking account to a retirement savings account, such as an individual retirement account (IRA) or a 401(k). This ensures that a portion of your income goes directly toward retirement savings before you have a chance to spend it.

- Take Advantage of Employer Contributions: If your employer offers a retirement savings plan with matching contributions, take full advantage of it. Contribute enough to maximize the employer match, as it is essentially free money that can significantly boost your retirement savings.

- Reduce Debt: Pay off high-interest debt, such as credit card balances, as soon as possible. By reducing debt, you free up more money to put towards retirement savings.

- Consider Downsizing: As retirement approaches, evaluate your housing needs. Downsizing to a smaller home or relocating to a more affordable area can help reduce expenses and increase retirement savings.

Remember, every individual's financial situation is unique, so it's important to personalize your saving and budgeting strategies to align with your specific needs and goals. Regularly review and adjust your budget as circumstances change to stay on track towards a financially secure retirement.

Investing Wisely

Investing wisely is a crucial aspect of preparing for retirement. By making smart investment decisions, individuals can grow their wealth and ensure a financially secure future. In this section, we will explore two important factors to consider when it comes to investing for retirement: diversifying your portfolio and understanding risk tolerance.

Diversifying Your Portfolio

Diversification is a fundamental strategy for reducing risk in investment portfolios. It involves spreading investments across different asset classes, industries, and geographical regions. By diversifying, investors aim to minimize the impact of any single investment on their overall portfolio. This strategy helps to protect against the potential losses that can arise from a decline in a particular investment or market segment.

Investors can diversify their portfolios by including a mix of stocks, bonds, mutual funds, exchange-traded funds (ETFs), and other investment vehicles. The idea is to have a balanced allocation that aligns with individual risk tolerance and long-term financial goals.

A diversified portfolio offers the potential for more stable returns and reduces the vulnerability to market volatility. It allows individuals to benefit from the growth potential of different asset classes while mitigating the impact of any single investment's performance.

Understanding Risk Tolerance

Understanding risk tolerance is crucial when making investment decisions. Risk tolerance refers to an individual's willingness and ability to withstand fluctuations in the value of their investments. It is influenced by factors such as age, financial goals, investment time horizon, and personal comfort with risk.

Investors with a high risk tolerance may be more comfortable with volatile investments that have the potential for higher returns over the long term. On the other hand, individuals with a low risk tolerance may prefer more conservative investments that prioritize capital preservation and stability.

To determine risk tolerance, investors can consider factors such as their time horizon for retirement, financial obligations, and personal preferences. It's essential to strike a balance between risk and potential returns that align with individual financial goals and comfort levels.

Understanding risk tolerance helps individuals select investment options that are appropriate for their specific circumstances. It ensures that investment decisions are in line with personal preferences and the desired level of risk exposure.

By diversifying their portfolios and understanding their risk tolerance, individuals can make informed investment decisions that contribute to their overall retirement readiness. It's important to review and adjust investment strategies periodically to accommodate changing financial goals and market conditions. Seeking guidance from a financial advisor can provide valuable insights and help individuals navigate the complexities of investing for retirement.

Maximizing Retirement Accounts

When it comes to preparing for retirement, maximizing your retirement accounts is a crucial step in securing your financial future. Two key retirement accounts that can help you build a substantial nest egg are 401(k) and IRA accounts.

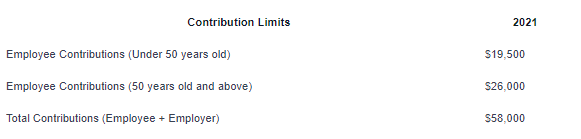

401(k) and IRA Contributions

A 401(k) is an employer-sponsored retirement account that allows employees to contribute a portion of their salary before taxes. These contributions grow tax-deferred until retirement. One of the significant advantages of a 401(k) is that it may include employer matching contributions, which can significantly boost your retirement savings.

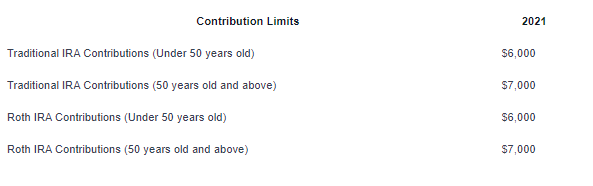

Individual Retirement Accounts (IRAs) are individual retirement savings accounts that offer tax advantages. There are two main types of IRAs: Traditional and Roth. With a Traditional IRA, your contributions may be tax-deductible, and the earnings grow tax-deferred. In contrast, Roth IRA contributions are made with after-tax dollars, but qualified withdrawals in retirement are tax-free.

By maximizing your contributions to these retirement accounts, you can take advantage of the tax benefits and potentially increase your retirement savings. It's crucial to review your financial situation and consult with a financial advisor to determine the optimal contribution strategy based on your individual circumstances.

Employer Matching Programs

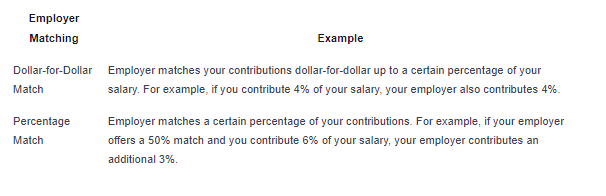

If your employer offers a matching program for your 401(k) contributions, it's important to take full advantage of this benefit. Employer matches can significantly boost your retirement savings by providing additional funds based on a percentage of your contributions.

Employer matching programs are essentially free money that can help accelerate your retirement savings. Be sure to understand the specific terms and conditions of your employer's matching program and contribute at least enough to maximize the full matching amount.

Maximizing contributions to your retirement accounts, such as 401(k)s and IRAs, and taking advantage of employer matching programs, are essential strategies to prepare for a financially secure retirement. Remember to regularly review your retirement goals, adjust your contributions as needed, and seek professional guidance to ensure you are on track to meet your retirement objectives.

Evaluating Healthcare Options

As you prepare for retirement, it's essential to consider your healthcare needs and explore the available options. Healthcare expenses can significantly impact your retirement finances, so evaluating and understanding healthcare options is crucial. In this section, we will discuss two important healthcare options to consider: Medicare and Medicaid, and long-term care insurance.

Medicare and Medicaid

Medicare and Medicaid are government-sponsored healthcare programs that provide assistance to eligible individuals, particularly those aged 65 and older. Understanding these programs can help you make informed decisions regarding your healthcare coverage during retirement.

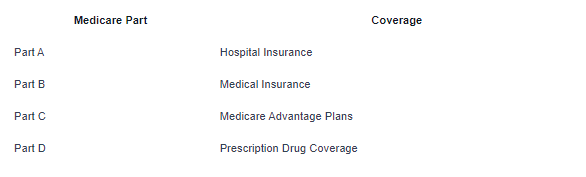

Medicare: Medicare is a federal health insurance program primarily designed for individuals aged 65 and older. It consists of different parts that cover specific healthcare needs:

Eligibility for Medicare typically begins at age 65, although some individuals may qualify earlier due to certain disabilities or medical conditions. It's important to review the different parts of Medicare to determine the coverage that best suits your needs.

Medicaid: Medicaid is a joint federal and state healthcare program that provides assistance to individuals and families with limited income and resources. Eligibility for Medicaid varies by state and is based on factors such as income, assets, age, and disability status. Medicaid can be an important healthcare safety net for retirees who meet the eligibility criteria.

Long-Term Care Insurance

Long-term care insurance is a type of insurance specifically designed to cover the costs associated with long-term care services. These services may include assistance with activities of daily living, such as bathing, dressing, and eating, which may be required due to chronic illness, disability, or cognitive impairment.

Long-term care insurance policies vary in terms of coverage, benefits, and costs. It's important to carefully evaluate different policies to determine the coverage that aligns with your long-term care needs and financial capabilities. Consider factors such as the waiting period, benefit period, daily benefit amount, and inflation protection when selecting a policy.

By evaluating healthcare options such as Medicare, Medicaid, and long-term care insurance, you can ensure that you have the necessary coverage to meet your healthcare needs during retirement. It's advisable to consult with a financial advisor or healthcare professional to understand the specific requirements, benefits, and limitations of these programs and insurance options. Proper planning and consideration of healthcare expenses can help you maintain financial stability and peace of mind throughout your retirement years.

Planning for Lifestyle Changes

As retirement approaches, it's important to consider the various lifestyle changes that come with this new phase of life. This section focuses on two key aspects to consider: Social Security benefits and hobbies and activities in retirement.

Social Security Benefits

Social Security benefits play a significant role in many individuals' retirement income. Understanding how these benefits work and planning accordingly can help ensure a more financially secure retirement. Here are some key points to consider:

- Eligibility: To qualify for Social Security benefits, individuals generally need to have earned a certain number of credits through their employment. The number of credits required varies based on the individual's birth year.

- Claiming Age: The age at which individuals choose to claim their Social Security benefits can impact the amount they receive. While individuals can start receiving benefits as early as age 62, delaying the claim until full retirement age (typically between 66 and 67, depending on the birth year) can result in higher monthly benefit amounts.

- Spousal Benefits: Married individuals may be eligible to receive Social Security benefits based on their spouse's work record, even if they have little or no work history themselves. Understanding spousal benefit options can help maximize overall Social Security income.

- Tax Considerations: It's important to be aware that Social Security benefits may be subject to federal income tax, depending on the individual's total income. Understanding the tax implications can help with retirement income planning.

For more detailed information on Social Security benefits, individuals can visit the official Social Security Administration website or consult with a financial advisor.

Hobbies and Activities in Retirement

Retirement offers a unique opportunity to explore new hobbies, activities, and interests. Engaging in fulfilling and enjoyable pursuits during retirement can contribute to overall well-being and a sense of purpose. Here are some ideas for hobbies and activities in retirement:

Hobbies and Activities

Traveling and exploring new destinations

Volunteering for a cause or organization

Pursuing artistic endeavors such as painting, writing, or playing a musical instrument

Joining clubs or groups related to personal interests, such as book clubs or gardening clubs

Engaging in physical activities like walking, swimming, or yoga

Learning new skills or taking up a new hobby, such as cooking, photography, or gardening

Retirement provides the freedom to pursue passions and interests that may have been put on hold during working years. It's important to plan for these activities and allocate time and resources to enjoy them fully.

By considering Social Security benefits and planning for hobbies and activities in retirement, individuals can enhance their overall retirement experience and make the most of this new chapter in their lives.

Sources

https://btcbank.bank/about/15-tips-to-help-prepare-for-retirement

https://www.merrilledge.com/article/7-steps-prepare-for-your-upcoming-retirement

Similar articles

How to Navigate Financial Options for Long-Term Care

The Role of Assistive Devices in Supporting Recovery

How to Stay Connected with Your Loved One in a Nursing Home

Understanding Long-Term vs. Short-Term Stays in Nursing Homes

Why Speech Therapy is Crucial for Patients Recovering from a Stroke

The Role of Aromatherapy in Senior Living Facilities

How Long-Term Care Facilities Ensure Comfort for Residents with Mobility Challenges

The Role of Continuing Education for Nursing Home Staff

The Role of Preventative Healthcare in Long-Term Care Facilities

How Physical Therapy Supports Recovery in Short-Term Rehab

How to Develop Strength Through Resistance Exercises

How to Improve Flexibility with Physical Therapy

How Family Therapy Can Support Recovery Efforts

How to Handle Conflict Resolution in a Nursing Home Setting

The Importance of Nutrition in Short-Term Rehabilitation Recovery

How to Maintain Mobility During Short-Term Rehabilitation

The Benefits of Hydrotherapy in Rehabilitation Programs

What to Know About Specialized Care for Stroke Survivors

How Nursing Homes Address Dietary Restrictions for Residents

How Long-Term Care Provides Stability and Comfort for Aging Adults

How to Make the Most of Physical Therapy in Short-Term Rehabilitation

How Speech Therapy Can Improve Cognitive and Language Skills in Seniors

How to Plan a Smooth Move to a Nursing Facility

How Nursing Homes Promote Independence Among Residents

How Nursing Homes Adapt to Cultural and Religious Needs

How Long-Term Care Facilities Ensure Safety and Security for Residents

How Long-Term Care Facilities Ensure Safety and Security for Residents

How to Find a Trustworthy Respite Care Provider

How to Encourage Hobbies That Support Recovery

Why Consistency is Key in Rehabilitation Exercises

Creating a Care Plan for Post-Surgical Wound Management

Benefits of Group Therapy in Rehabilitation Facilities

How to Develop a Positive Mindset for Rehabilitation Success

How to Build Confidence After Surgery or Injury

How to Manage Post-Traumatic Stress After an Injury

Managing Chronic Illness with Short-Term Rehabilitation

Creating a Daily Recovery Checklist for Patients

Creating a Daily Recovery Checklist for Patients

How to Use Adaptive Equipment for Daily Living Tasks

How to Regain Hand Strength After Surgery or Injury

How to Improve Communication Skills Through Speech Therapy

How to Adapt Your Home for Safe Mobility After Rehabilitation

How to Improve Posture for Better Recovery Outcomes

How to Create a Safe Sleeping Environment for Recovery

How to Manage Emotional Burnout During Recovery

How to Safely Perform Daily Living Activities After Surgery

How to Prevent Bedsores in Long-Term Rehabilitation

How to Maintain Positive Relationships During Recovery

How to Adapt to Lifestyle Changes After Surgery

Creating a Structured Routine for Rehabilitation Success

Creating a Meal Plan for Post-Rehabilitation Nutrition

How to Encourage Positivity in a Loved One’s Recovery Journey

Tips for Managing Weight During the Rehabilitation Process

How to Cope with Long-Term Pain After Surgery

The Role of Peer Support Groups in Recovery

How to Manage Side Effects of Pain Medications

The Role of Cognitive Behavioral Therapy in Rehabilitation

The Role of Cognitive Behavioral Therapy in Rehabilitation

How to Overcome Isolation During Rehabilitation

How to Manage Chronic Pain Without Medication

Strategies for Enhancing Cognitive Skills During Recovery

The Role of Caregivers in Supporting Rehabilitation Patients

How Art and Music Therapy Enhance Rehabilitation Outcomes

How to Manage Joint Pain in Rehabilitation

How to Avoid Common Setbacks in Short-Term Rehabilitation

How to Handle Stress During the Rehabilitation Process

How to Identify Signs of Depression During Recovery

How to Manage Blood Pressure During Rehabilitation

The Benefits of Holistic Approaches in Rehabilitation

How to Help Seniors Transition from Rehabilitation to Home

Coping with Muscle Stiffness During Rehabilitation

How to Strengthen Weak Muscles After Surgery

How to Manage Fatigue During Physical Therapy

How to Build Core Strength in Rehabilitation

How to Develop Coping Strategies for Physical Limitations

How to Develop a Meditation Routine for Stress Relief

How to Develop Better Sleeping Habits During Recovery

Creating a Positive Mindset for Recovery

The Role of Recreational Therapy in Rehabilitation Centers

Managing Depression During Short-Term Rehabilitation

Coping with Limited Mobility During Short-Term Rehabilitation

How to Build a Strong Support System During Rehabilitation

The Benefits of Music Therapy in Rehabilitation

How to Develop Patience During the Recovery Process

How to Manage Energy Levels During Recovery

The Importance of Goal Setting in Rehabilitation

How to Build Emotional Resilience During Recovery

The Role of Acupuncture in Rehabilitation Care

How to Stay Connected with Friends During Recovery

The Role of Chiropractic Care in Rehabilitation

How to Develop Fine Motor Skills During Recovery

How to Develop Time Management Skills in Recovery

The Role of Skilled Nursing in Long-Term Care

The Benefits of Life Story Work for Seniors in Long-Term Care

How Nursing Homes Support Seniors After Surgery

The Role of Preventive Care in Long-Term Care Facilities

The Benefits of Skilled Nursing Facilities for Seniors

The Benefits of Occupational Therapy for Seniors in Long-Term Care

How to Choose the Right Short-Term Rehabilitation Facility

How to Create a Comfortable Therapy Environment for Seniors

How to Plan for Future Long-Term Care Needs

How Short-Term Rehab Can Improve Quality of Life for Seniors

The Role of Occupational Therapy in Short-Term Rehabilitation

How to Advocate for Your Loved One in a Nursing Home

How Nursing Homes Coordinate with Hospitals for Seamless Care

The Advantages of Short-Term Rehabilitation in Nursing Homes

How Physical Therapy Enhances Mobility in Long-Term Care Residents

The Importance of Specialized Care for Chronic Conditions

How Recreational Therapy Supports Emotional Well-Being in Long-Term Care

Understanding the Different Therapies Offered in Short-Term Rehabilitation

The Role of Peer Support Groups in Senior Care Facilities

The Connection Between Mental Health and Senior Care

The Importance of Consistency in Therapy for Long-Term Care Residents

What to Expect During a Nursing Home Admission Process

What to Expect from a Respite Care Stay in a Skilled Nursing Facility

How to Maximize the Benefits of Short-Term Rehabilitation Therapy

The Benefits of Short-Term Respite Care for Seniors

The Role of Care Coordination in Managing Multiple Therapies

How to Identify the Best Short-Term Rehabilitation Facility for Your Needs

The Role of Advanced Medical Services in Short-Term Rehabilitation

The Difference Between Outpatient and Inpatient Short-Term Rehabilitation

Top Questions to Ask When Touring a Nursing Facility

How Nursing Homes Manage Chronic Pain for Seniors

The Importance of Hydration in Senior Care

The Importance of Personalized Care Plans in Respite Care

How to Transition from Hospital to Short-Term Rehabilitation Seamlessly

How to Know When a Loved One Needs Respite Care Services

How to Ensure Continuity of Care in a Long-Term Care Setting

The Benefits of On-Site Specialists in Long-Term Care Facilities

The Benefits of On-Site Specialists in Long-Term Care Facilities

How to Prevent Rehospitalization After a Short-Term Rehab Stay

The Role of Physicians in a Long-Term Care Setting

How Aqua Therapy Benefits Seniors in Rehabilitation and Long-Term Care

The Importance of Nutrition in Short-Term Rehabilitation

How Short-Term Rehabilitation Prepares Patients for a Safe Return Home

How Personalized Care Plans Enhance Medical Services in Long-Term Care

The Importance of 24/7 Nursing Care in Long-Term Care Facilities

The Importance of Palliative Care in Long-Term Care Facilities

The Benefits of Professional Nursing Support in Respite Care

How to Support a Loved One in Short-Term Rehabilitation

How Respite Care Can Help Families Navigate Caregiver Fatigue

How to Prepare for a Short-Term Rehabilitation Stay

How Therapy Supports Aging Adults with Neurological Disorders

How Short-Term Rehabilitation Supports Recovery After Joint Replacement

How Short-Term Rehabilitation Supports Recovery After Joint Replacement

How Respite Care Supports Family Caregivers and Their Loved Ones

How Long-Term Care Facilities Provide Individualized Therapy Plans

How Family Involvement Supports Short-Term Rehabilitation Success

The Benefits of Having Access to Medical Services During Respite Care

How Skilled Nursing Supports Recovery in Short-Term Rehab

How Therapy Encourages a Faster Return to Daily Activities After Injury

What to Expect from Medical Services in a Skilled Nursing Facility

The Importance of Occupational Therapy in Daily Living Activities for Seniors

How Pain Management Enhances Recovery in Short-Term Rehab

How Sensory Stimulation Therapy Supports Seniors with Dementia

How Speech Therapy Supports Communication and Swallowing in Long-Term Care

The Benefits of Short-Term Respite Care for Seniors and Families

How to Maximize Progress During a Short-Term Rehabilitation Stay

The Connection Between Physical and Mental Health in Long-Term Care Therapies

How Pain Management Therapy Enhances Comfort for Long-Term Care Residents

How to Advocate for High-Quality Medical Services in Long-Term Care

How Respiratory Therapy Helps Manage Breathing Conditions in Long-Term Care

Common Conditions Treated in Short-Term Rehabilitation Programs

The Benefits of Short-Term Rehabilitation for Seniors

How to Incorporate Therapy into Daily Life in a Long-Term Care Facility

How to Choose the Right Therapy Program for a Senior’s Needs

The Importance of Personalized Care in Short-Term Rehabilitation

What to Do if You Suspect Neglect in a Nursing Home

How Nursing Homes Offer Support for Grieving Families

How Nursing Homes Utilize Telemedicine for Resident Care

How Alternative Therapies Support Wellness in Long-Term Care Facilities

How Nursing Homes Support Seniors with Respiratory Conditions

How Nursing Homes Promote Mental Wellness for Seniors

The Benefits of Regular Family Visits for Nursing Home Residents

How to Recognize the Signs That a Loved One Needs Long-Term Care

How Mental Health Support Helps in Short-Term Rehabilitation

How Nursing Homes Provide Emergency Medical Services

How Nursing Homes Provide Support for Parkinson’s Patients

Tips for Communicating Effectively with Nursing Home Staff

How to Choose the Right Nursing Home for Your Loved One

The Importance of Social Activities in Senior Care Homes

Why Family Involvement Matters in Long-Term Senior Care

Tips for Helping Seniors Adjust to Life in a Nursing Facility

The Role of Speech Therapy in Treating Swallowing Disorders

How Nursing Homes Handle End-of-Life Care with Dignity

How to Maintain Progress After Completing Short-Term Rehabilitation

How to Identify Warning Signs of Illness in Elderly Residents

How to Identify Warning Signs of Illness in Elderly Residents

How Personalized Therapy Plans Enhance Short-Term Rehabilitation

The Importance of Mental Health Services in Long-Term Care

How Short-Term Rehabilitation Supports Recovery from Orthopedic Injuries

The Importance of a Support Network in Short-Term Rehabilitation

How to Handle Emotional Challenges During Short-Term Rehabilitation

Why Short-Term Rehabilitation is a Stepping Stone to Long-Term Care

How to Stay Engaged and Active in a Long-Term Care Setting

The Role of Dietitians in Short-Term Rehabilitation

The Role of Recreational Therapy in Short-Term Rehabilitation

How Personalized Care Enhances Recovery in Short-Term Rehab

How to Avoid Complications During Short-Term Rehabilitation

The Benefits of Group Therapy in Short-Term Rehabilitation

The Benefits of Short-Term Rehabilitation for Faster Recovery

The Role of Hospice Care in Long-Term Care Facilities

The Role of Physical Therapy in Long-Term Care for Maintaining Mobility

How to Transition from Short-Term Rehabilitation to Home Care

How Physical Therapy Improves Strength and Mobility in Short-Term Rehab

How Short-Term Rehab Helps Prevent Hospital Readmissions

How Respite Care Helps Seniors Transition to Long-Term Care

How Caregivers Can Support a Patient’s Short-Term Rehabilitation Journey

The Benefits of Palliative Care in Long-Term Care Facilities

How Personalized Care Plans Improve Short-Term Rehabilitation Outcomes

How Long-Term Care Facilities Support Family Involvement

Understanding Memory Care Services in Long-Term Care

How Short-Term Rehabilitation Prepares Patients for Independent Living

How Support Groups Help Families Navigate Long-Term Care Decisions

Why Short-Term Rehabilitation is Essential After Joint Replacement Surgery

The Role of Nutrition in Long-Term Care for Healthy Aging

Managing Pain Effectively in Short-Term Rehabilitation

How to Plan Financially for Long-Term Care Services

How Social Activities Improve Mental Well-Being in Long-Term Care

How Personalized Long-Term Care Plans Improve Quality of Life

What to Expect During a Short-Term Rehabilitation Stay

Speech Therapy in Short-Term Rehabilitation: Why It Matters

The Role of Medical Supervision in Respite Care Programs

How Short-Term Rehab Helps Patients Transition Back Home Successfully

The Role of Therapy Dogs in Short-Term Rehabilitation Recovery

How to Manage Medications During Short-Term Rehabilitation

How Short-Term Rehab Helps Patients Regain Independence

How Medical Services Support Chronic Disease Management in Long-Term Care

The Importance of Advance Directives in Long-Term Care

The Role of Therapy Dogs in Nursing Homes

How Nursing Homes Address Sleep Challenges in Seniors

Nutrition and Dining Services in Nursing Homes

How Nursing Homes Enhance Residents’ Quality of Life

The Impact of Cognitive Therapy on Residents with Dementia

The Importance of Infection Control in Senior Care Facilities

How Nursing Homes Support Families of Residents

The Benefits of 24/7 On-Site Medical Care in Nursing Homes

How to Transition Between Skilled Nursing and Home Care

How Nursing Facilities Ensure the Safety of Residents with Mobility Issues

Myths About Nursing Homes: What Families Need to Know

Signs It’s Time to Transition to a Nursing Home

How Nursing Facilities Incorporate Technology into Therapy Programs

How to Build Strong Relationships with Nursing Home Staff

The Benefits of Intergenerational Programs in Senior Care

How Nursing Homes Manage Pain for Their Residents

How to Encourage Social Interaction Among Seniors in Care

The Role of Volunteer Programs in Nursing Facilities

The Role of Physical Therapy in Nursing Homes

How Nursing Homes Address the Emotional Needs of Seniors

What Families Should Know About Caregiver Ratios in Nursing Homes

The Benefits of Pet Therapy in Senior Living Communities

How to Recognize Quality Care in a Nursing Facility

The Transition from Hospital to Skilled Nursing Care

How Nursing Homes Incorporate Residents’ Personal Preferences

The Impact of Group Activities on Senior Well-Being

Arthritis Knee Support

Assisted Living Facility Statistics

How To Care For Aging Parents When You Can't Be There?

Occupational Therapy Games For Elderly

Nursing Home Readmission Rates Statistics

Do Nursing Homes Provide Hospice Care?

Benefits Of Pet Ownership For The Elderly

Stages Of Frontotemporal Dementia

Senior Education Programs

Nursing Home Neglect Statistics

Memory Care Facility Statistics

Homestead Hospice And Palliative Care

What Is Cardiac Care?

Woodworking And Crafts For Retirees

Nursing Home Facilities Near Me

Healthy Aging Workshops

Nursing Home Cost Statistics

Affordable Senior Living Near Me

Bariatric Care Facilities

Cooking Demonstrations For The Elderly

Art Galleries And Museum Visits

Healthcare For Seniors Statistics

Knee Pain Over 70 Years Old Treatment

Benefits Of Yoga For Seniors

What Services Are Available For The Elderly?

What Causes Knee Pain In Old Age?

Best Nursing Homes Near Me

Technology For Seniors

Free Government Programs For Seniors

Senior Health Outcomes Statistics

Day Trips And Excursions For Seniors

Activities For Seniors With Limited Mobility

What Is Outpatient Rehab?

Cost Of Memory Care Facilities Near Me

Drug Addiction In Seniors

Financial Management For Elderly

Home Healthcare Statistics

Virtual Support Groups For Seniors

Free Services For Seniors

Virtual Support Groups For Seniors

Tai Chi And Yoga For Older Adults

Nursing Home Physical Therapy Utilization Statistics

How Much Does Outpatient Rehab Cost?

Rehabilitation Facility Statistics

Nursing Home Resident Demographics Statistics

How To Prevent Seniors From Falling?

How To Treat Alcoholism In The Elderly?

Medicare Nursing Home Payment Statistics

Best Nursing Homes For Dementia Near Me

Seniors Addicted To Phone

Substance Abuse Among Seniors

Seasonal Celebrations For Retirees

Aging Population Statistics

Assistive Devices For The Visually Impaired

Wine Tasting Events For Retirees

Government Programs For Seniors Home Repairs

Retirement Community Amenities

Active Adult Communities

Senior Living Statistics

How To Deal With Aging Parent With Memory Issues?

Why Seniors Want To Stay In Their Homes?

Palliative Care Statistics

Senior Care Health & Rehabilitation Center

Elderly Care Resources

Nursing Home Mortality Rates Statistics

7 Stages Of Dementia Before Death

Medicare Coverage Options

Exercise Equipment For Seniors

Senior Care Facility Statistics

Games For Seniors With Dementia

Nursing Home Emergency Room Transfer Statistics

Elderly Care Statistics

Alzheimer's Care Statistics

High Blood Pressure In Elderly

What Does A Speech Therapist Do For Elderly?

Qualifications For Respite Care

Nursing Home Discharge Rates Statistics

Nursing Home Regulatory Compliance Statistics

Nursing Home Admission Rates Statistics

Average Length Of Stay In Nursing Homes Statistics

Nursing Home Medication Error Statistics

Home Health Care Agencies

Elderly Population Demographics Statistics

How To Prevent Knee Pain In Old Age?

Elder Law Considerations

Early Signs Of Alzheimer's Are In The Eye

Elderly Living Alone Problems

Average Cost Of Respite Care

Theater And Musical Performances For Elderly

Knitting And Crochet Groups For The Elderly

Nursing Homes With Hospice Care Near Me

More Than a Thousand Nursing Homes Reached Infection

What Causes Falls in the Elderly? How Can I Prevent a Fall?

Heart Healthy Recipes & Foods for Seniors

The Best Recumbent Bikes for Seniors

How Do You Eat Heart-Healthy on a Budget?

Tips for Dealing with Stubborn Aging Parents

What Can I Do About My Elderly Parent's Anxiety?

Falls in Older Adults

The Benefits of Exercise Bicycles for Senior Wellness

Incredibly Heart-Healthy Foods

Mental Health Resources For The Elderly

Early Signs Of Alzheimer's In 50s

End-Of-Life Care Statistics

Activities For Blind Seniors With Dementia

Heart Health For Seniors

Caring For Elderly Parents

How Long Does Stage 7 Dementia Last?

Dementia Care Statistics

Medicaid Eligibility Criteria

Government Assistance For Seniors With Low-Income

Benefits Of Pet Therapy For Seniors

Is Arthritis Avoidable?

Nursing Home Dementia Care Statistics

Senior Employment Resources

Dementia Support Services

Best Pain Medication For Elderly Patients

What Is Senior Care Services?

Senior Housing Subsidies

What Is Heart Failure In The Elderly?

Leisure Activities For Retirees

Hospice Care Statistics

Geriatric Care Statistics

Dual Diagnosis In Older Adults

Residential Care Facility Statistics

The Complete Guide to Senior Living Options

What to Expect When Starting Hospice Care at Home

Hospice Care While Living in a Nursing Home

Traditions Health: Hospice & Palliative

What Does In-Home Hospice Care Provide?

Homestead Hospice & Palliative Care

Different Types of Elderly Care Living Options

Do Nursing Homes Provide Hospice Care?

Where Is Hospice Care Provided and How Is It Paid For?

Why Hospice in the Nursing Home?

Affordable Housing Options For Retirees

How To Deal With Elderly Parents Anxiety?

Mindfulness And Meditation For Seniors

Heart-Healthy Foods For Seniors

Assisted Living Benefits

Residential Care Homes Near Me

Memory Care Facilities Near Me That Accept Medicare

Travel Options For Seniors

Memory Care Facilities Near Me

Activities For Seniors Near Me

Substance Use Disorder In Older Adults

How To Prevent Falls At Home For Elderly?

Senior Pharmacy Services

Assisted Living For Autistic Adults Near Me

Government Grants For Elderly Care

Lifelong Learning Opportunities

Skilled Nursing Facility Statistics

Fishing And Boating Excursions For Seniors

How Many Hours Of Respite Care Are You Allowed?

Social Media Tutorials For Seniors

Does Speech Therapy Help Alzheimer's?

Dual Diagnosis in Older Adults

Prescription Drug Misuse Among Older Adults

Alcoholism in the Elderly

Treatment for Substance Abuse in Older Adults

Overcoming the Dangers of the Elderly Living Alone

Living Alone with Dementia

Brain Games & Memory Exercises for Seniors

Activities to Enjoy if Someone Has Alzheimer's or Dementia

NHA Turnover and Nursing Home Financial Performance

Nursing Home Affiliated Entity Performance Measures

Addiction Rehab for Seniors & Elderly Adults

Nursing Home Care Statistics 2024

Engaging Nursing Home Residents with Dementia in Activities

Nurse Staffing Estimates in US Nursing Homes

Living Alone with Dementia: Lack of Awareness

Nursing Home Quality and Financial Performance

The Quality of Care in Nursing Homes

Nursing Home Staffing Levels

Meaningful Activities for Dementia Patients

Staffing Instability and Quality of Nursing Home Care

The National Imperative to Improve Nursing Home Quality

Organizational Culture and High Medicaid Nursing Homes

Alcohol & Aging: Impacts of Alcohol Abuse on the Elderly

Prescription Drug Abuse in the Elderly

Nursing Home Staffing Data

Determinants of Successful Nursing Home Accreditation

Caregiver Statistics

Who Are Family Caregivers?

The Important Role of Occupational Therapy in Aged Care

Cost Of Drug And Alcohol Rehab

Older Adult Fall Statistics and Facts

Benefits of Living in a Golf Course Community

Retirement Hot Spots for Golfers

Best Online Resources for Older Adults

Understanding Senior Companion Care

Elderly Companion Care

Hospice Foundation of America

Personal Hygiene: Caregiver Tips for At-Home Hospice Patients

How To Care For A Hospice Patient as a Caretaker

Hospice Care in an Assisted Living or Skilled Nursing Facility

Can you Receive Hospice Care in a Nursing Home?

Resources for Aging Adults and Their Families

Hospice Care in the Nursing Home

What Senior Care Options are Available for the Elderly?

Determinants of Successful Nursing Home Accreditation

Senior Care: Know Your Options

Nursing Home Falls Cause Injury & Death

Benefits of Occupational Therapy for Elderly

Companion Care for Seniors

Different Alternatives to Nursing Homes for the Elderly

Behavioral Health Care for Seniors

The Effect of Nursing Home Quality on Patient Outcome

Drug Rehab Success Rates and Statistics

Palliative Care Facts and Stats

The Importance Of Home Safety

Best Safety Devices for Seniors

Household Safety Checklist for Senior Citizens

What Is the Best Type of Yoga for Seniors?

Foods that are Good for your Kidneys

Tips to Relieve Stress of Caring for Elderly Parents

Hearing Aid: How to Choose the Right One

The Importance of Maintaining a Safe Home & Yard

How Many People Need Palliative Care?

Home Safety for Older Adults

An Aging-in-Place Strategy for the Next Generation

How Do Seniors Pay for Assisted Living?

What is Personal Home Care?

Caregiver Stress and Burnout

Most Recommended Forms Of Yoga For Seniors

The Best Hearing Aids for Seniors

Learn the Six Steps to Aging In Place Gracefully

Avoiding Burnout when Caring for Elderly Parents

Nursing Home Mortality Rates and Statistics

Occupancy is On the Rise in Nursing Homes

How to Pay for Assisted Living: A Comprehensive Guide

How to Deal With Aging Parents' Difficult Behaviors

Dealing with Aging Parents

Seven Signs Elderly Parents Need More Support at Home

Factors to Consider Before Moving Your Elderly Parents In

Tips on How to Cope with Parents Getting Older

Resources for Adult Children Caring For Aging Parents

This Is What Happened When My Parents Moved In

Arthritis Awareness Month

Signs Your Elderly Parent Needs Help

Take Extremely Good Care of Your Elderly Parents

The Role of the Speech Pathologist in Aged Care

The Benefits of Cooking Classes for Seniors

Trusted In Home Care for Seniors & Quality Senior

Benefits of Telemedicine for Seniors

Advantages & Benefits of Home Care for Seniors

Fun Classes for Senior Citizens to Take

Telemedicine in the Primary Care of Older Adults

What is End-Stage Dementia?

Cooking Activity Ideas for Seniors & the Elderly

Late-Stage Dementia and End-of-Life Care

Volunteer Abroad Opportunities for Seniors and Retirees

Health Benefits of Music Therapy for Older Adults

Understanding Assisted Living Levels of Care

Guidelines for Admission to the Acute Inpatient

Senior Care Services & Assisted Living Levels of Care

Benefits of Inpatient Rehabilitation

Amazing Benefits Of Music Therapy for Seniors

Inpatient Vs. Outpatient Rehab

What is Inpatient Rehab?

Are There Different Levels of Assisted Living?

Why Seniors Should Join a Knitting Club

Teaching Older Adults to Knit and Crochet

A Beginner's Guide to Power of Attorney for Elderly Parents

Long Term Care Planning

What to Expect When Starting Hospice Care at Home

Home Health Aide Do's and Don'ts

What Are Home Health Aides Not Allowed To Do

Hospice Home Care What to Expect

Late Stage and End-of-Life Care

What End of Life Care Involves

Healthful Foods for Fighting Kidney Disease

Depression in Elderly Parents: How to Help

Moving a Person with Dementia into a Caregiver's Home

How Long do People Live in Hospice Care?

Eating Right for Chronic Kidney Disease

The Hospice Care in Nursing Homes Final Rule

The Role of Hospice Care in the Nursing Home Setting

Seven Tips for a Successful Move to Dementia Care

Ways to Help Your Elderly Parents Deal With Depression

Does Hospice Cover 24-Hour Care at Home?

Golden Years Gourmet: Cooking Classes for Seniors

The Best Phones for Seniors in 2024

Nursing Home Care Compare

Home Health Aids vs. Personal Care Aides

Top 5 Benefits of Cooking Classes for the Elderly

Care in the Last Stages of Alzheimer's Disease

What Is a Home Health Aide?

Memory Care Facilities That Accept Medicaid and Medicare

The Best Cell Phones for Older Adults

Dementia and End of Life Planning

Exercise Bikes For Seniors

What is a Rehabilitation Center for the Elderly?

What to Know About Senior Centers

Why Senior Outings Are Important?

The Power of Creative Writing Exercises for Senior Minds

Wordfind: Cultural Activities for Seniors

Popular Senior Center Book Club Books

Birdwatching Helps Older Adults Reconnect with Nature

What Services Do Senior Centers Provide?

Top 5 Benefits of Senior Book Clubs

Does an Older Adult in Your Life Need Help?

Enriching Assisted Living and Nursing Home Activities

High Blood Pressure and Older Adults

Tips to Avoid Heatstroke and Heat Exhaustion

What Are the Causes of Hypertension in Older Adults?

Preventing Heat-Related Illness

Assisted Living Activities and Calendar

Caregiving: Taking Care of Older Adults

Signs Your Aging Parent Might Need Help

Heatstroke - Symptoms and Causes

What Is Long-Term Care?

Hospice Care in the Nursing Home

What Are the Four Levels of Hospice Care?

Home Health Aide Duties: What Does an HHA Do?

How Many Hours Can a Home Health Aide Work?

How to Become a Paid Caregiver for Elderly Parents

Pros And Cons Of Nutritional Supplement Drinks

How Long is the Average Hospice Stay?

In-Depth Guide on Taking Care of Elderly Parents

Nourishing and supplementary drinks

Can I Afford a CCRC? Here's What You Need To Know

Guardianship-Acting for the Disabled Adult

Helpful Online Resources for Seniors

Are Continuing Care Retirement Communities a Good Idea?

Does Medicare Cover Palliative Care?

Helping an Elder Make a Power of Attorney

Medicare and End-of Life Care: What to Know About Coverage

Guardianship and Conservatorship of Incapacitated Persons

How to Get Power of Attorney for an Elderly Parent

Online Resources for Senior Health

Speech Therapy for People with Alzheimer's

Occupational Therapy Sensory Processing Disorder

Speech Therapy and Alzheimer's Disease

Healthy Weight Gain for Older Adults

The Benefits of a Senior Rehabilitation Center

Treating Sensory Processing Issues

What to Look for When You Need Senior Rehabilitation

Top Foods To Help Seniors Gain Weight

What to Expect When Your Loved One Is Dying

End-of-Life Stages Timeline for Hospice Patients

Different Types of Trusts for Seniors

Estate Planning for Seniors: What to Know

Hospice Care Vs. A Nursing Home

Tips on How to Take Care of the Elderly in Your Home

Mental Health Of Older Adults

How Long Does The Average Hospice Patient Live?

What Drugs Are Used in End-of-Life Care?

What to Do When You Can't Care for Elderly?

Older Adults and Mental Health

End-of-Life Care: Managing Common Symptoms

How Long Can You Be On Hospice?

End-of-Life Care and Hospice Costs

Hospice vs. Nursing Home: What is the Difference?

Does Medicare Cover Memory Care Facilities?

Can I Take Care of Elderly in My Home?

Adult Disability Homes (ADHs)

Long-Term Care Facilities: Types and Costs

Residential Care Homes for Disabled Adults

Hospice Care at Home Cost: What You'll Pay

Is Memory Care Covered by Medicare?

Types of Facilities - Long-Term Care - Senior Health

Ageing and Long-Term Care

Understanding Long-Term Care for Older Adults

Long-Term Care Facilities

Understanding Residential Care Homes for Disabled Adults

What is Memory Care?

What Is Respite Care?

Are Nursing Homes Covered by Long-Term Care Insurance?

What Does Independent Living Mean in the Senior Living?

Personal Transportation for Seniors

Best Home Remodels For Aging In Place

Eldercare Resources

Top 10 Ways to Prepare for Retirement

The Best Mobility Devices for Seniors in Every Environment

Independent Living for Seniors

Understanding Long-Term Care Insurance

Services for Older Adults Living at Home

What is Senior In-Home Care? Home Health Care Guide

Retirement Home vs. Long Term Care

3 Types of Long Term Senior Living

5 Retirement Planning Steps To Take

What is a Memory Care Facility?

The Ultimate List of Aging in Place Home Modifications

Health Benefits of Pet Therapy in Seniors

The Benefits of Pet Therapy for Senior Caregiving

What Are the Options for Senior Transportation?

Does Insurance Cover Nursing Homes?

What Is Retirement Planning?

8 Useful Mobility Aids for Seniors with Disabilities

What Is Pet Therapy for Seniors?

Transportation for Older Adults

What is the Specialized Dementia Care Program

Does Insurance Pay for Nursing Home?

Nursing Home vs. Memory Care: What's the Difference?

Benefits of Pet Therapy for Seniors

What is the Average Length of Stay for Rehab?

Unpacking Assisted Living

Why Do Seniors Want to Stay in Their Homes?

Palliative Care vs. Hospice: Which to Choose

How to Report a Home Health Aide?

What Is A Home Health Nurse?

How Long Can You Stay in Acute Rehab?

What is Home Nursing Care and What Does it Cover?

The Right Alzheimer's Care for Your Loved One

Difference Between Hospice and End-Of-Life Care

Taking Care of Elderly Parents Quotes

Top 10 Complaints from Home Care Clients

How to Get an Elderly Person into a Care Home

Your Guide To Luxury Senior Living

Aging in Place: Growing Older at Home

What Qualifies for Acute Rehab?

The Mental Health Benefits of Socializing for Seniors

How Much Does Inpatient Physical Rehab Cost?

What Is The Difference Between Acute And Subacute Rehab?

Inpatient Rehab Physical Therapy

Exercise Programs That Promote Senior Fitness

The Benefits of Socialization for Seniors in Senior Living

Total Body Strength Workout for Seniors

Healthy Eating Tips for Seniors

Best Wellness Programs for Seniors

Falls and Fractures in Older Adults: Causes and Prevention

What are Acute Care Rehab Facilities?

Home Safety Tips for Older Adults

Assisted Living Activity Calendar Ideas

Why Inpatient Rehabilitation

6 Smoothies & Shakes for Seniors

Supplement Drinks for Elderly: Dietitian Recommendations

What Is Acute Rehabilitation?

Top 5 Incredible Home Made Nutritional Drinks for Seniors

What Is a Continuing Care Retirement Community?

What Are Palliative Care and Hospice Care?

Twelve Self-Care Tips for Seniors

Dietary Supplements for Older Adults

The Importance of Nutrition For The Elderly

What is Palliative Care for the Elderly?

Nutritional Needs for the Elderly

The Best Nutrition Drinks for Adults and Seniors

Essential Vitamins and Minerals for Seniors

Providing Care and Comfort at the End of Life

What To Look For in a Senior Rehab Facility

Why Is Self-Care Important for Seniors?

Alzheimer's & Dementia Care Options

Help With in-Home Care for Someone With Alzheimer's

How To Find In-Home Care For Disabled Adults

What is Personal Care? | Helping Hands Home Care

Specialized Care Facilities - Senior Living

Top 10 Tips For Caring For Older Adults

How Many Skilled Nursing Facilities are in the U.S.?

Importance of Elderly Care Services

Specialized Care Facilities Differ From Nursing Homes

Best Special Care Units for Older Adults

Senior Rehab: Better Care Options After a Hospital Stay

What are the Benefits of a Senior Rehabilitation Center?

Differences Between Skilled Nursing Facilities and Hospitals

What Services Do Seniors Need Most?

Senior Continuing Care Communities

How Much Does a CCRC Cost?

How Continuing Care Retirement Communities Work

What is a Continuing Care Retirement Community?

The Top 10 Benefits of a Skilled Nursing Facility

Who Should Go to a Skilled Nursing Facility?

What is a Skilled Nursing Facility?

3 Main Benefits Of Continuing Care Retirement Community

Family Medical Care Center

Home Care for Disabled Adults

7 Benefits of In-Home Care for Older Adults

Home Care Services for Seniors: Aging in Place

Personal Care Needs of the Elderly

Caregiver Duties for Disabled Adults

A Guide to VA Nursing Homes

What Are the Types of Nursing Homes?

Hospital vs. Freestanding: Which setting is the best?

What is Urgent Care Medicine?

Requirements for Nursing Home Administrator Licensure

What is Data Privacy in Healthcare?

When Is It Time for a Nursing Home?

Kaiser Permanente and Senior Care Coverage

Nursing Home Employee Background Checks

Types of Services Offered at a Skilled Nursing Facility

Do VA Benefits Pay for a Nursing Home?

Skilled Nursing Facilities

Moving Into a Nursing Home: A Packing List

Benefits of a Free-Standing Treatment Center

Acute Rehabilitation vs. Skilled Nursing

Types of Skilled Nursing Care

Average Cost of Skilled Nursing Facilities in 2024

When Medicare Stops Covering Nursing Care

Inpatient Acute Rehabilitation Centers

Patient Confidentiality

What Kinds of Services Are Provided at Urgent Care?

Best Gift Ideas for Nursing Home Residents

How does a Patient Qualify for Skilled Nursing Care?

Veterans Eligibility for VA Nursing Home Care

6 Nursing Home Resident Necessities

What Qualifies a Person for a Nursing Home?

The Q Word Podcast: Emergency Nursing

How to Find In-Home Care Financial Assistance

What Is a Home Health Aide? A Career Guide

Levels of Healthcare

Types of Home Health Care Services

Differences Between Assisted Living and Nursing Homes

What Aged Care Homes Provide

What To Bring To A Skilled Nursing Facility

What Is A Home Care Grant

Does Medicare Pay for Nursing Homes?

What to Expect from Skilled Nursing

What is In-Home Care?

How Much Does Long-Term Care Insurance Cost?

Skilled Nursing Facility vs. Nursing Home

Skilled Nursing Facility Levels of Care

What to Expect When Working in a Nursing Home

Nursing Home Costs and Payment Options

Nursing Home Insurance

Nursing Home Requirements: Who's Eligible?

What Caregivers Should Know About Nursing Home Care

How Can I Pay for Nursing Home Care?

Understanding the Four Levels of Hospice Care

The Top Amenities Every Skilled Nursing Home Should Have

A Guide to Nursing Homes

Guidance for Elderly Individuals on Handling Disabilities

Contact us today and experience ”The Name in Healthcare”

Where compassion, well-being, and a welcoming community converge to redefine your healthcare journey. Welcome to Rosewood, where your family becomes our family.